The company that I work for is offering a fabulous "perk"...it offers many perks, but this one is the most valuable by far. This one is going to change how we deal with money...and that will affect everything in our lives.

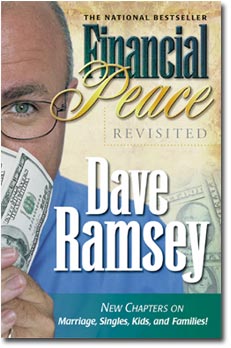

Every other Wednesday, from today until October, those interested will meet for a two-hour lunch to listen to Dave Ramsey lead us through his program to financial peace. Our company bought every participant this book, and there is a workbook to go along with it. Many churches offer this program, with a hefty entry fee. Our company is offering it to us all for FREE.

Dave Ramsey lost everything in the 80s...and now, 15 years later, he is living with financial peace. He's showing us how to do it. How to change our thinking.

I personally know someone that has gone through this program, and he swears by it. He now has financial freedom. Don't we all want that?? I thought I would share some of the things that I learn throughout this program. Maybe it could help you too...

Look at these stats:

:: 70% of all consumers live from paycheck to paycheck. (I know we do!)

:: 46% have less than $10,000 saved for their retirement. (Luckily, we've started this!)

:: America has a savings rate of -2.2%! (Savings? What savings?)

So, here are some things worth sharing from our program today:

:: SAVING must become a priority. Save first and THEN pay bills. You save for emergencies, purchases, and wealth building.

:: Unexpected events WILL happen. You should have an Emergency Fund to deal with these emergencies. You should NOT deal with emergencies by using a credit card.

:: Step One of the Program -- create a beginner Emergency Fund of $1000.

:: This Emergency Fund should NOT be touched for purchases. Emergencies only. You should sit down and make up a list of what you will define as emergencies. Those will be the only things this fund can be used for. The best idea is to set up a savings account and for each paycheck, have funds automatically deposited into this account. You will never see the money. It can never be used for something else accidentally.

:: The only way to make a purchase is with cash. If you save up to buy something, you can often negotiate a discount and get a better deal.

So...we've even got homework. We've got to read 4 chapters in his book, work up a Quickie Budget of where we are right now, decide how we'll define an emergency, and write down small bite-size goals that we would like to achieve before the end of the program. We've got our work cut out for us. But, I have been so so looking forward to this program. Chris and I are both ready to get real and get our money in order. We're ready.

To be continued...hope this helps you guys too!!!

2 comments:

This program sounds VERY very interesting!! Thanks so much for sharing everything here with us. I would for Gary and I to take this program! I look forward to more post on this matter!

Very cool. :)

Post a Comment